More About Clark Wealth Partners

Table of ContentsThe 25-Second Trick For Clark Wealth PartnersSee This Report on Clark Wealth PartnersMore About Clark Wealth PartnersThe Only Guide to Clark Wealth PartnersAll About Clark Wealth PartnersSome Ideas on Clark Wealth Partners You Need To KnowSee This Report on Clark Wealth PartnersNot known Incorrect Statements About Clark Wealth Partners

Typical reasons to think about a financial advisor are: If your financial circumstance has come to be more complex, or you lack self-confidence in your money-managing skills. Saving or browsing significant life events like marriage, separation, children, inheritance, or task modification that might dramatically influence your financial scenario. Browsing the shift from saving for retirement to maintaining wealth during retirement and just how to produce a strong retired life earnings plan.New technology has actually led to even more extensive automated monetary devices, like robo-advisors. It's up to you to investigate and figure out the right fit - https://www.easel.ly/browserEasel/14614718. Inevitably, a great economic expert should be as mindful of your financial investments as they are with their own, staying clear of extreme costs, saving cash on taxes, and being as transparent as possible regarding your gains and losses

Facts About Clark Wealth Partners Revealed

Earning a compensation on product suggestions doesn't necessarily imply your fee-based expert functions versus your best rate of interests. However they might be much more likely to recommend product or services on which they make a compensation, which might or may not remain in your benefit. A fiduciary is legally bound to put their customer's rate of interests initially.

They may comply with a loosely monitored "viability" requirement if they're not registered fiduciaries. This common permits them to make recommendations for investments and solutions as long as they match their customer's goals, danger tolerance, and financial circumstance. This can convert to recommendations that will certainly additionally make them money. On the other hand, fiduciary advisors are legitimately obliged to act in their customer's finest interest rather than their very own.

What Does Clark Wealth Partners Do?

ExperienceTessa reported on all points investing deep-diving right into intricate economic topics, clarifying lesser-known investment avenues, and discovering means readers can function the system to their benefit. As a personal financing specialist in her 20s, Tessa is acutely familiar with the impacts time and uncertainty have on your financial investment choices.

It was a targeted advertisement, and it worked. Read much more Review less.

The Greatest Guide To Clark Wealth Partners

There's no single path to ending up being one, with some individuals starting in banking or insurance coverage, while others begin in accounting. A four-year level gives a strong structure for occupations in investments, budgeting, and client services.

The Ultimate Guide To Clark Wealth Partners

Common instances include the FINRA Collection 7 and Series 65 exams for safeties, or a state-issued insurance coverage permit for offering life or medical insurance. While qualifications might not be legally required for all planning functions, companies and clients usually view them as a standard of expertise. We look at optional credentials in the following section.

Many economic planners have 1-3 years of experience and experience with economic the original source products, conformity standards, and direct customer communication. A strong educational background is vital, but experience shows the ability to use theory in real-world settings. Some programs integrate both, enabling you to finish coursework while making supervised hours with teaching fellowships and practicums.

Clark Wealth Partners Fundamentals Explained

Early years can bring long hours, stress to build a client base, and the demand to continuously show your competence. Financial planners appreciate the opportunity to function closely with customers, guide vital life choices, and often accomplish versatility in schedules or self-employment.

Riches supervisors can increase their profits through payments, property fees, and efficiency rewards. Financial supervisors manage a team of financial planners and advisers, setting department approach, managing conformity, budgeting, and directing interior procedures. They invested less time on the client-facing side of the sector. Almost all economic managers hold a bachelor's level, and several have an MBA or similar academic degree.

Excitement About Clark Wealth Partners

Optional accreditations, such as the CFP, commonly need additional coursework and screening, which can expand the timeline by a number of years. According to the Bureau of Labor Stats, individual financial experts make an average yearly annual wage of $102,140, with leading earners making over $239,000.

In various other provinces, there are policies that need them to meet certain requirements to utilize the monetary expert or economic planner titles. For economic planners, there are 3 common designations: Qualified, Individual and Registered Financial Organizer.

8 Easy Facts About Clark Wealth Partners Explained

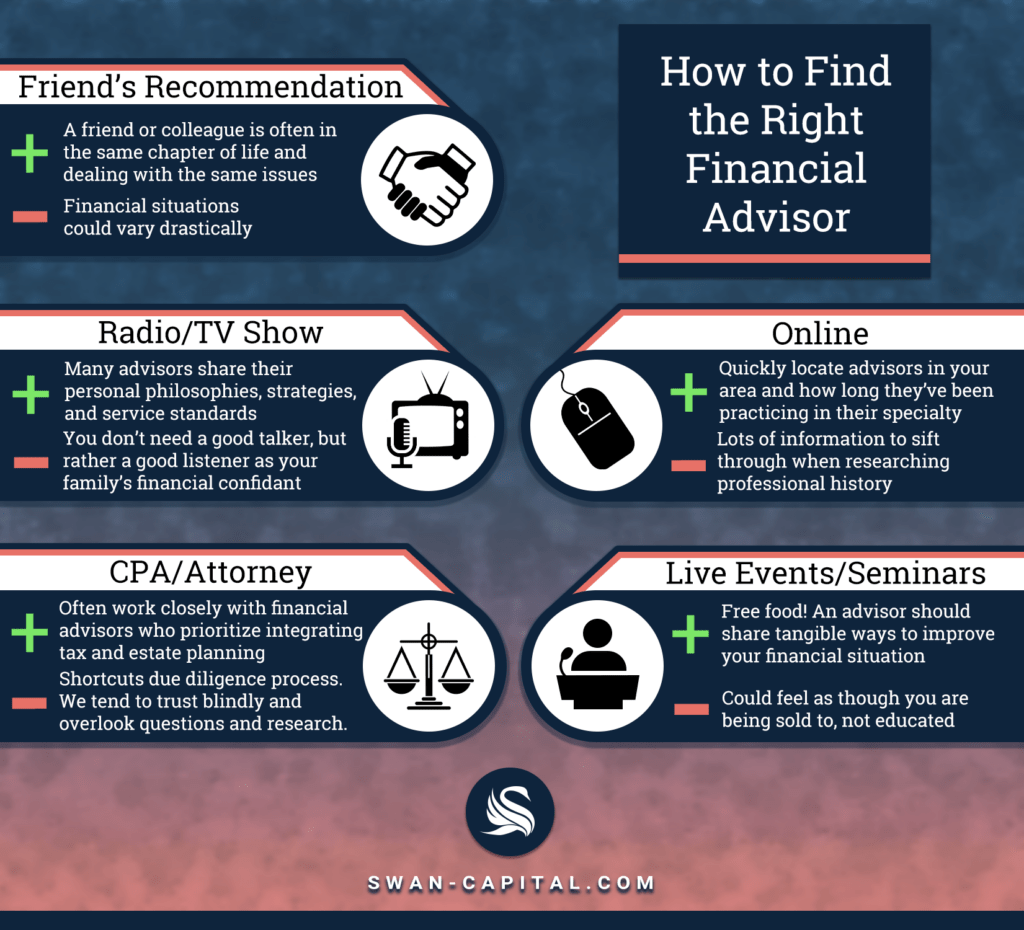

Those on wage might have an incentive to promote the services and products their employers provide. Where to discover a financial expert will certainly depend upon the sort of suggestions you require. These institutions have personnel that might help you understand and buy certain kinds of financial investments. For example, term deposits, assured financial investment certifications (GICs) and common funds.